Light and heavy disputes: companies really bear less than 40% tax burden

"China Times": Although the official said that the fiscal and tax reforms are accelerating and the results are remarkable, why are there still controversies in the community, and even feel that the tax burden is not decreasing?

Feng Qiaobin: If we take the "Decision of the Central Committee of the Communist Party of China on Comprehensively Deepening Reforms of Some Major Issues" as a starting point, it is generally considered that this round of fiscal and taxation system reform is basically completed: the budget reform is basically completed, and the reform of the taxation system is halfway. And the reform of the central local fiscal system has just begun. As far as the tax reform itself is concerned, it is hard to say that it has finished 80%. Compared with the main tasks and objectives of the tax reform proposed in 2013, it should be about half now. The current society and the government have different views on the progress of the tax system, reflecting many deep-seated problems. To put it simply, the reform of the entire fiscal and taxation system is currently at the threshold of “management†to “governanceâ€, and it is still on the other hand. At this time, everyone's feelings may be more divided. Some people look back, some people look forward, the direction is different, and the perception is naturally different.

As for the tax burden, there have been many discussions since last year and this year, and we have a lot of research on this. In the end, the tax is not heavy. Why do people and enterprises feel that taxes are heavy, and according to some official external explanations, it seems that taxation is not heavy? The situation is actually quite clear, the key is the tax structure. Now the tax structure is mainly based on indirect taxes, which will make the company feel that it bears a lot of tax burdens. It feels that it is the main taxpayer. In addition, the current economic downturn, the situation is not good, and the corporate "tax pain" is relatively strong.

For taxation, I have always insisted on three sentences:

First, taxation is a necessary evil. When the current social parties call for tax cuts and complaints about taxation, it is particularly important to point out that taxes cannot be demonized. As long as human beings form a society, form an organization, operate, and develop, they must be taxed. Of course, in different periods, the form of taxation is not the same.

Second, the total amount of tax revenue can not be reduced. The total amount of tax burden in China is not as important as the society imagines. The available data show that from the 1990s to the present, China's macro tax burden calculated by tax is about 18%-19%. This level is not high compared to developed or developing countries. Therefore, the problem of taxation is not on the total amount. The social questioning is mainly non-tax, government funds outside the taxation, as well as state-owned capital operating profits, social security contributions, including the housing fund that is now receiving much attention, and some have not yet been put into public discussion such as the coinage tax, etc. All of this adds up, and the burden on society is heavier. This is because the Chinese government's income is more diverse, but these are not all taxes, and many are extra-tax burdens. In addition, in the course of the operation of the extra-tax burden, there are indeed problems such as insufficient standardization, insufficient transparency, and insufficient binding force, which has aggravated the social “painâ€.

Third, the key to taxation is the tax structure. Today, the Chinese tax system is mainly based on indirect taxes and supplemented by direct taxes. The basic feature of this tax structure is that it mainly taxes products or services in the production and distribution sectors. To be straightforward, companies only need to open a door to do business, regardless of whether they make money or not, as long as they sell goods or services, their tax liability is immediately generated. This tax system has caused companies to feel that their tax burden is particularly heavy. In the process of tax payment, what proportion of the tax payment, calculation base, deductible, and non-deductible, what are the relevant tax regulations, and the taxation practice and taxation policy in the process of tax operation These problems have increased the taxpayer's psychological pressure, business pressure, and the corresponding human, material, and financial resources.

The tax burden actually assumed by enterprises is mainly corporate income tax, which is really burdened by enterprises, and the nominal tax rate is 25%. However, there are a large number of preferential reductions and exemptions around corporate income tax, including SME exemptions, innovative corporate exemptions, and so-called park exemptions. After the seven reductions and eight reductions, the actual tax burden of the income tax paid by the enterprise is far below the level of 25%. As for the turnover tax, which is the bulk of the business, including the fees, funds, social security and other transfer fees involved in the business process, the enterprises have joined the price and passed on. Of course, some enterprises have turned out, some have not turned out, sometimes they turn a little more, and sometimes they turn a little less. Indeed, there are changes depending on the business environment. But if you look at it a little more abstractly, indirect taxes must be added to the price, and then recovered through product sales. This is a complicated process of tax transfer. Therefore, those who actually bear these taxes are the consumers who buy goods and services, that is, ordinary consumers like you, me, and him. As long as we go to buy goods and services, some of the price is tax, the people are the tax bearers, and the real taxpayers. In terms of turnover tax, the enterprise is a taxpayer, but not a taxpayer.

In fact, these companies understand very well. However, under the current tax system, 90% of the tax is paid by the enterprise to the tax authorities, not by the individual consumers to the tax bureau. I have done the calculation, the company really bears less than 40% tax.

Difficulties in solving problems: the power of government at all levels must be clearly divided

"China Times": After so many years of fiscal and tax reform, what should be changed if we do a simple review and analysis? What is the hard bone of the so-called fiscal reform?

Feng Qiaobin: The biggest improvement in fiscal and tax reform in the past two years is the reform of budget management. One of the most important advances was the implementation of a full-scale budget. Now the government budget has changed from one book to four books. From the original general public budget, there are now government fund budgets, social security budgets, and state-owned capital operating budgets. It is the most progressive piece of budget reform after the adoption of the new Budget Law in 2014.

Second, the biggest improvement is the open budget. This is an improvement that can be seen in all aspects of society. Especially this year, the time for the budget is open and the content is very detailed. Around the budget disclosure, a relatively reasonable institutional mechanism has been formed. After the public budget this year is released, the calm in the society is the best explanation for this.

Third, reforms in budget management have also made great progress. From the "one year budget, one year budget" to the current implementation of the medium-term budget system, it is a big leap. The medium-term budget is a three-year or five-year medium-term budget system, which means that the work plans and funding arrangements of various government departments no longer only consider the one-year vision, but also consider the overall arrangement of three to five years. This is a major change.

Fourth, reforms in the government accounting system have made great progress. From the realization of the payment system to the accrual system, this is a fundamental institutional change in the government budget. Although it is not moving, it has a great impact, but few people in the society pay attention to such technological changes.

Fifth, the overall management of fiscal funds has been significantly tightened. There is a huge amount of financial stock funds that cannot be used in the accounts. On the one hand, it seems to be a bad thing, on the other hand, it shows that financial management has been strengthened, and it is also a good thing. It is not like how to use it.

Of course, there are still some problems in the reform of the budget management system. For example, do you use all the funds as financial funds to manage the same way as government departments? This is particularly prominent in the education and technology ports. This is one aspect of continuing to work hard to reform in the future. But overall, we have a higher evaluation of the progress of the budget management system reform.

In terms of tax reform, it has gone half. In the reform of the "six taxes and one law" proposed by the Third Plenary Session of the 18th CPC Central Committee, there are now three tax reforms in place in the six taxes; although the "one law", that is, the "Tax Collection and Administration Law" has not been formally implemented, it has long been consulted. Draft. The three taxes completed in the “Six Taxes and One Law†refer to the increase in the business, the resource tax, and the environmental protection tax. In addition, the draft of the “Tax Collection and Administration Law†has been issued for a long time, which is half the progress. The other half of the reforms that have been delayed are one tax, one is real estate tax, and the other is consumption tax. These three taxes are currently undergoing slower reforms.

In the reform of the central local fiscal system, the goal is to establish a central local fiscal system that is compatible with the responsibility of expenditure and expenditure. This aspect has only just begun. Taking the State Council's No. 49 document “Guidelines on Promoting the Reform of the Central and Local Financial Accounts and Expenditure Responsibility†on August 24, 2016, some provinces have successively issued provincial-level powers. This reform was initiated with the expenditure responsibility reform plan. However, it is very difficult and difficult. From the current progress, it can only be called just getting started. The so-called fiscal and tax reform "hard bones" refers to this reform, the core of which is the division of central and central power.

The current central local fiscal system is called the tax-sharing system. The tax-sharing system has a “troikaâ€: the right to work, the financial power, and the transfer payment, the core of which is the power of the matter. The division of powers is to clearly divide the scope of their respective powers and responsibilities between the central and local governments. In the economic and social affairs, it is clear what is the central responsibility and what is the local responsibility. Further, “local†is also a general concept. In theory, it is necessary to clarify the relationship between powers and responsibilities between the governments at the provincial, city, county, and township levels.

This problem is solved first because it is beyond the scope of the financial sector. For the division of government responsibility of all levels of government, the financial department can only play the role of shaking the flag. However, in reality, if this problem is confused with each other, the phenomenon level will first break out in the financial field. Therefore, it is necessary to make this problem clear from the financial point of view. Otherwise, there will be many problems in the government financial management system. But to really divide the scope of powers and responsibilities, you need the top-level design. From the experience of many countries, it is clear at the level of the Constitution. From this point of view, the Ministry of Finance must not do this. In China, this matter also involves the middle-level editors responsible for the allocation of powers and responsibilities between governments at all levels, the list of powers, the list of responsibilities, etc. Many related matters need to be rationalized there. From the perspective of the central spirit revealed now, in the division of government affairs at all levels, the Chinese editorial office must take the lead. However, this also involves a very complicated issue of power structure, involving the state administrative system and political system. It is very difficult to make it clear in general and to push it hard.

On the basis of clearing the power of the matter, we can know which level of government should give it how much money, and how to give money. This is the problem that the expenditure responsibility and transfer payment system should solve.

"China Times": Clearly dividing the scope of powers and responsibilities of central and local governments, and solving this big problem requires decision makers to make up their minds?

Feng Qiaobin: From a technical perspective, China has more than 20 years of experience in tax sharing, and there are also experiences in dividing countries in the world for reference and reference. Therefore, this is indeed a question of determination. In addition, we must also see that the division of power is too clear. The greater the constraints on governments at all levels, especially the higher levels of government, the smaller the room for change and adjustment. This may also be the reluctance of some parties to actively The important reason.

How to go on the road: small reforms and big reforms

"China Times": I understand this way, the degree of modernization of China's fiscal and taxation system still has a certain gap compared with developed countries.

Feng Qiaobin: There must be a gap. You are quite right. The modernization of the national governance system and governance capacity was only introduced in 2013. Judging from the various aspects, the Chinese society has not yet achieved modernization, so the fiscal and taxation has not been modernized. The reason why the fiscal and taxation issues will become the focus of discussion in all aspects of society is because the contradictions and focus of social, economic and political aspects will first be reflected in the financial situation. Therefore, finance is often a focus or epitome of this society. However, the financial sector alone relies on solving problems and has limited space. There is still a need for a reform that requires reform from a holistic perspective.

Some literatures now recall that when the tax-sharing reform was promoted in 1994, it was actually a linkage reform of finance, taxation, and price. This is the overall design of the reform. At that time, the system framework of the tax-sharing system was first designed. The taxation system was reformed around the tax-sharing system. That is, the small reforms saw the big reforms, the big reforms saw the core reforms, and the levels were relatively clear. We must first grasp the "class" and grasp the "leading". Compared with the same year, the current fiscal and tax reforms, although the whole society also attaches great importance to it, there are indeed areas for improvement in the reform methods and specific strategies.

"China Times": Taking real estate tax as an example, although the academic circles and the market believe that accelerating real estate tax legislation may be an unavoidable trend, modern countries should have real estate taxes, but why is controversy constantly and the progress is slow?

Feng Qiaobin: The real estate tax has been discussed for 10 years. The biggest progress is that people who are rational, or who can stand a little farther to see the economic and social operations, can basically form a consensus: real estate tax legislation is the trend of the times, its necessity Needless to say. There is also a progress: around the real estate tax, the relevant technical preparations have been sufficient, such as some local tax authorities have carried out simulation operations, and some places have conducted real estate tax pilots, have accumulated experience. In addition, the real estate registration system has progressed rapidly in the last two years.

However, real estate tax is a typical direct tax, which is imposed on families and individuals. It involves thousands of ordinary people, and it will produce sharp “tax painâ€. The people have to express their opinions on this. Different people may have completely different opinions. This is normal. However, after the different opinions are fully expressed, there is still an opinion integration mechanism, but who will integrate and how to integrate?

In the past, the integration of different opinions or interests may be more the responsibility of the leaders and the government has the final say. But not now, because there are too many aspects involved, we need a different opinion integration mechanism than the past. The question is here, what exactly is this integration mechanism? Because this is not clear, it is difficult to push behind. For example, real estate tax legislation, everyone thinks it should be, but even so, after entering the legislative process, there are still opinions of all parties, and the first, second and third trials are open for public comment. How do these opinions integrate and how do they respond? The issue of real estate tax legislation profoundly and vividly reflects the pains faced by China towards modernization.

International attention: VAT system shares experience around the world

"China Times": "Belt and Road" Beijing International Summit opened soon, the official said in a sentence, after the implementation of the pilot reform of the camp reform in May last year, China is considered to have basically built a world-leading significance The modern VAT system, especially the financial services such as banking, insurance and securities, has been fully included in the scope of VAT collection, which is groundbreaking in the international arena. How to interpret, is it self-blowing?

Feng Qiaobin: This is correct, not self-blowing. The history of the VAT system is not long, and it will take several decades. After the “reform of the campâ€, the total amount of tax generated by the value-added tax has accounted for 40% of the entire tax structure, and the volume is extremely large. In addition, the scope of value-added tax has now covered the first, second and third industries, and the entire chain has been pulled. It is indeed groundbreaking in the world. What's more special is that China is currently the first country in the world to impose VAT on the financial industry. Even in Europe, where the value of VAT originated, this has not been done.

"China Times": Why did some developed countries fail to do so?

Feng Qiaobin: First, the financial industry itself is extremely complicated, with fast business changes and many categories. How to calculate the “value-added†part is difficult in itself. Second, VAT is an indirect tax. Many developed countries have low dependence on indirect taxation. Naturally, there is no high-level collection technique, collection method and collection theory. Many Western countries, including the United States, mainly focus on income tax, and there is no value-added tax. Although some countries in Europe have value-added tax, they account for a relatively small proportion, unlike China, which is highly dependent on value-added tax.

"China Times": Is VAT dependent on advanced performance?

Feng Qiaobin: It used to be backward, but it was time to move to the world. It seems that it has become advanced now. From the perspective of the evolution of the tax system, there is a transition from indirect taxation to direct taxation. When a country's economy is not developed very much, most of it is mainly based on indirect taxes; when the degree of economic development is high, the task of regulating income distribution is heavy, and it turns to direct taxes. Of course, this process is very painful, just like the situation in China today, but this is the law of taxation evolution. Looking at the structure of China's tax system in this way is not advanced enough because we are mainly indirect taxes, while developed countries are mainly based on direct taxes. But now there are some new situations, that is, capital has been highly mobile among countries since globalization, and income tax is to collect taxes on capital gains. In the case of high capital flows, it is more difficult for sovereign states to receive this tax or collect taxes. For example, many multinational corporations in the United States do not transfer their profits overseas, and the US government does not receive income tax on these enterprises. In view of this, some international tax organizations have made judgments, and new changes are likely to occur in the future. Relatively speaking, VAT is levied at the place of production and operation, and the liquidity of the tax base is weaker than that of capital. Therefore, in order to facilitate tax collection, sovereign countries are likely to turn to pay more attention to indirect taxes including VAT. Therefore, it is also possible to levy VAT in the future than to levy income tax.

"China Times": China's fiscal and taxation system reform will have any good changes and bad problems in the next few years. Do you have any good policy suggestions?

Feng Qiaobin: First, I hope that in accordance with the 2013 Decision of the Central Committee of the Communist Party of China on Comprehensively Deepening the Reform of Some Major Issues, the new round of fiscal and taxation system reform will be put in place. Second, we must carefully grasp the balance between the reform of the tax system and the acceptance of the issue. Third, grasp the balance between global tax cuts and China's fiscal and tax reforms. For example, what is the impact of Trump tax cuts on China? How to hedge, you also need to plan ahead and make careful decisions.

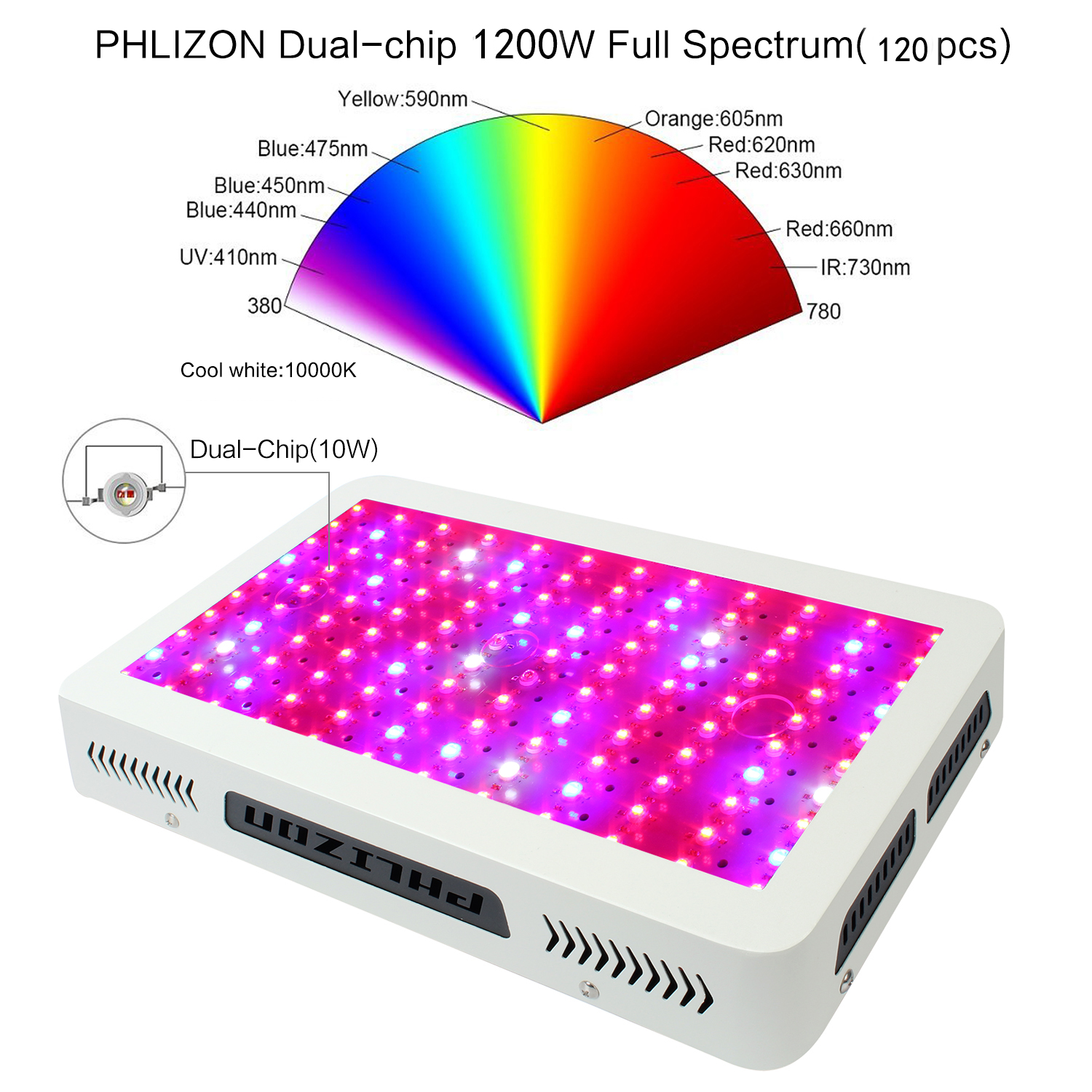

Products Description

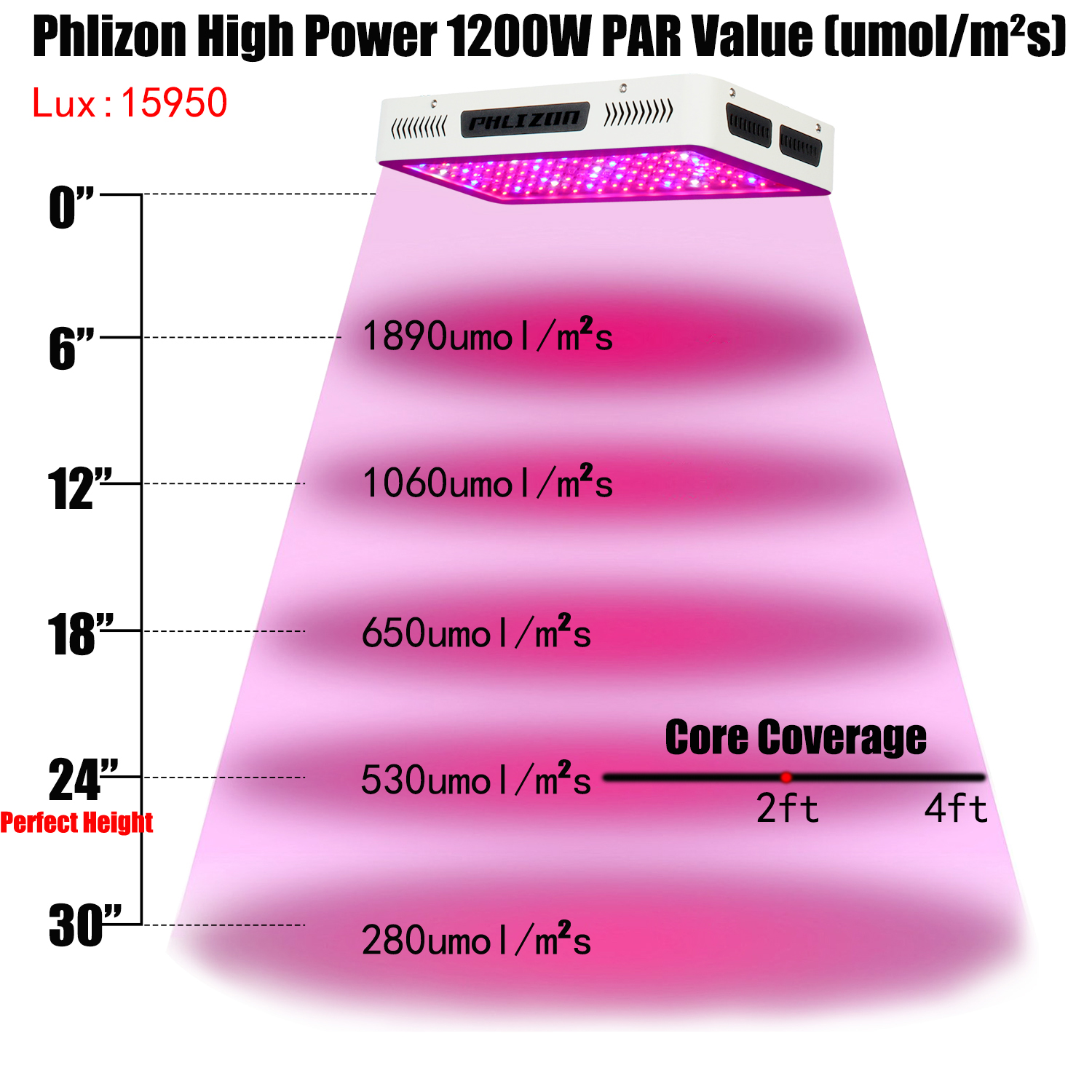

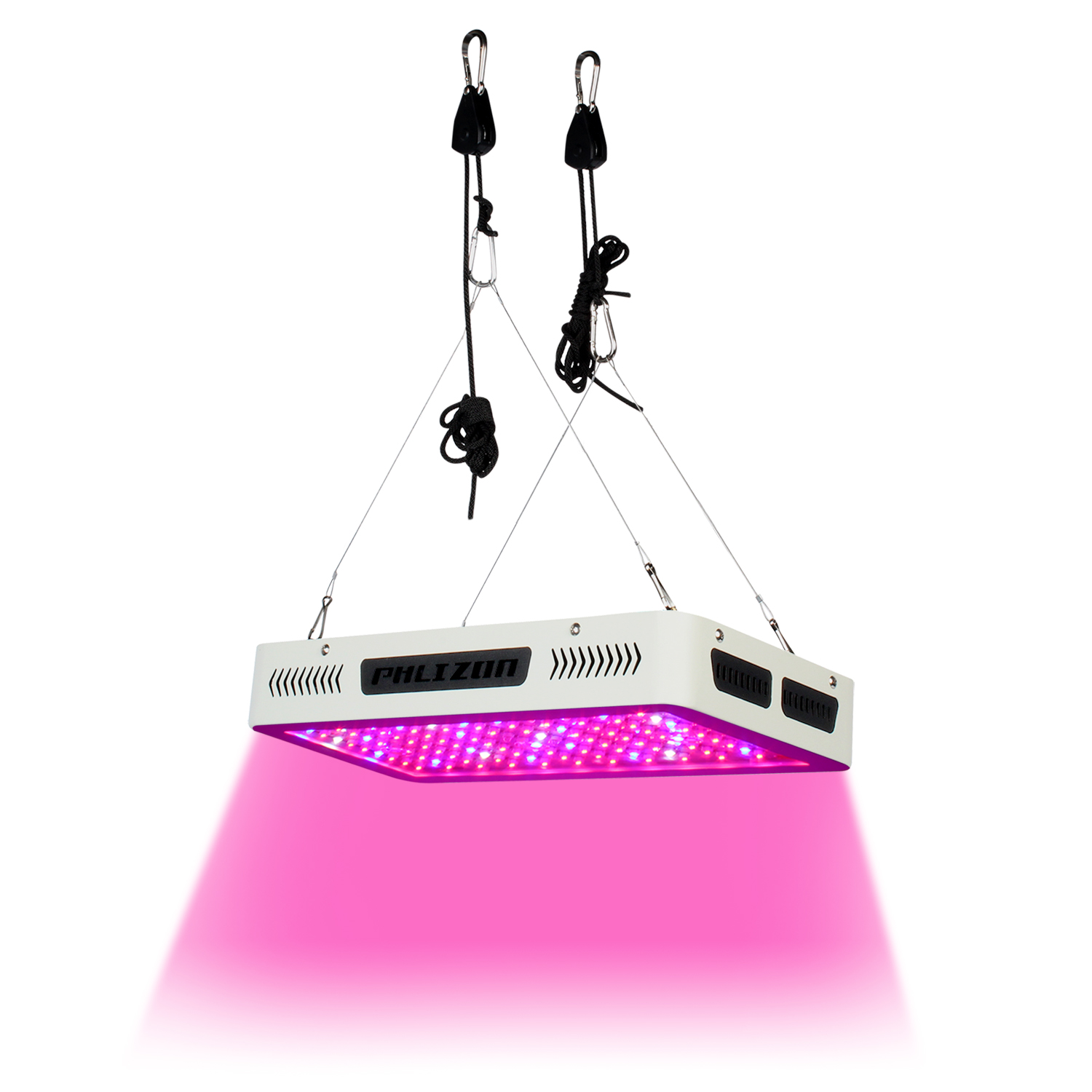

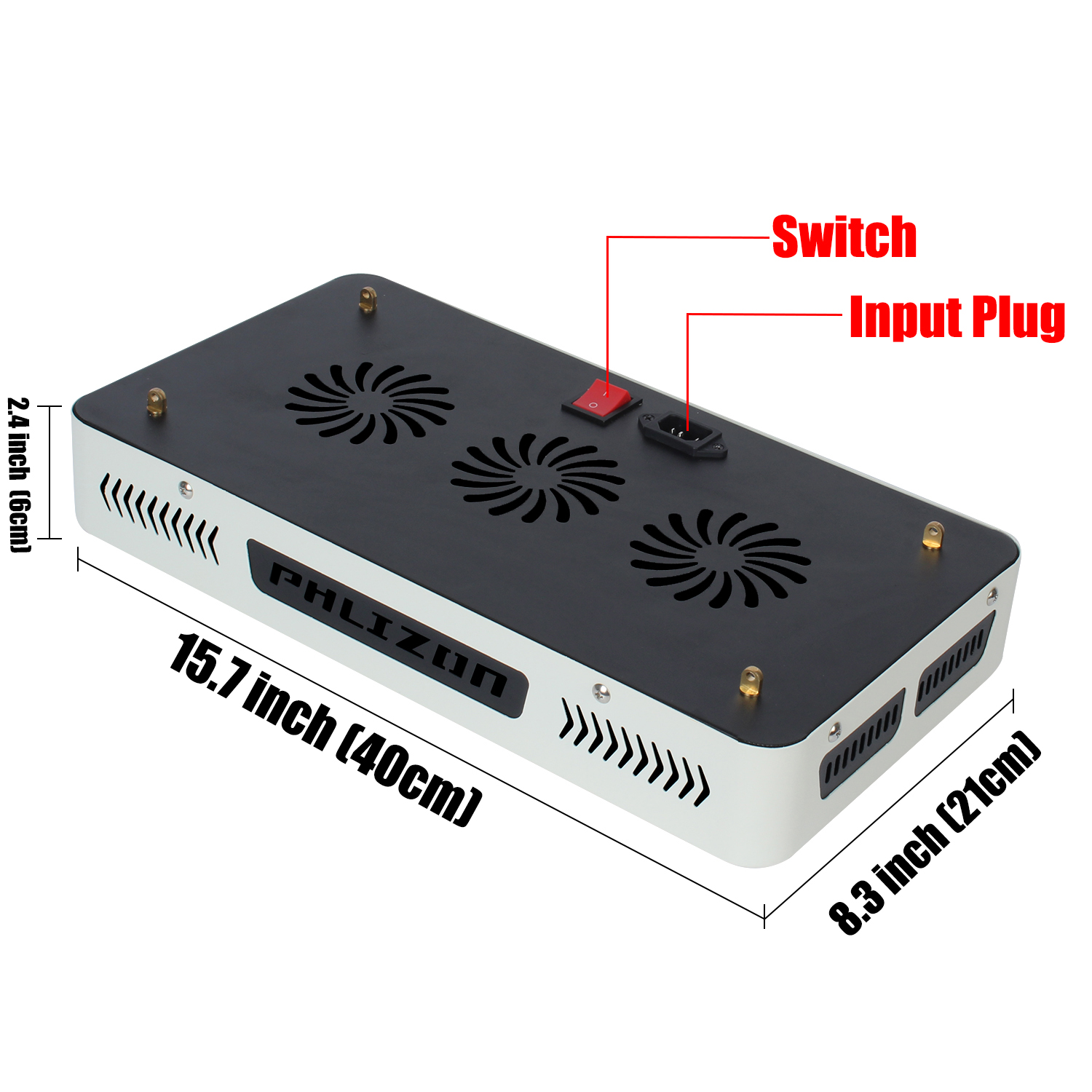

LED Grow Light is the newest trend for indoor growers. Advanced LED Grow Lights use less energy,and create less heat,not only provides intense, effective lighting for indoor gardening but also make the garden cool. Hydroponics,which is a method in high-tech horticulture where plants grow in soil-free nutrient baths,led hydroponic lamp is a perfect example of how science and technology can work together to develop solutions to human problems.

Advantages for led grow light

1. Bring You High Yield

The traditional grow lights, such as HID and HPS can just bring you 0.5 -0.8 gram per watt, no more than 1 gram. But the led grow light can bring you 1-2.5 gram per watt. It's amazing! LEDs in greenhouses deliver same yield as grow lights, using just 25% of the energy. So as for the energy conservation and environmental protection light source, the planters will consider the led grow light as their first choice.

2. Less Heat

While most grow lights are very warm, as HID, so you would need use the fan to solve this problem in summer. LED grow lights are generally moderate in temperature, and they will not harm a person if he touches them. As such, it is much safer and convenient for owners and their crops, they can be placed very close to the plants to deliver high intensity lights to the surface of the leaves.

3. Low Cost On Everything

Less electricity, save about 60% than HID.

Low amounts of heat, means less money spent on the room's costs of cooling.

Long life-span, no need to replace the bulbs.

No ballast.

No reflector.

Full Spectrum LED plant Grow Light and High Value View

Item Display

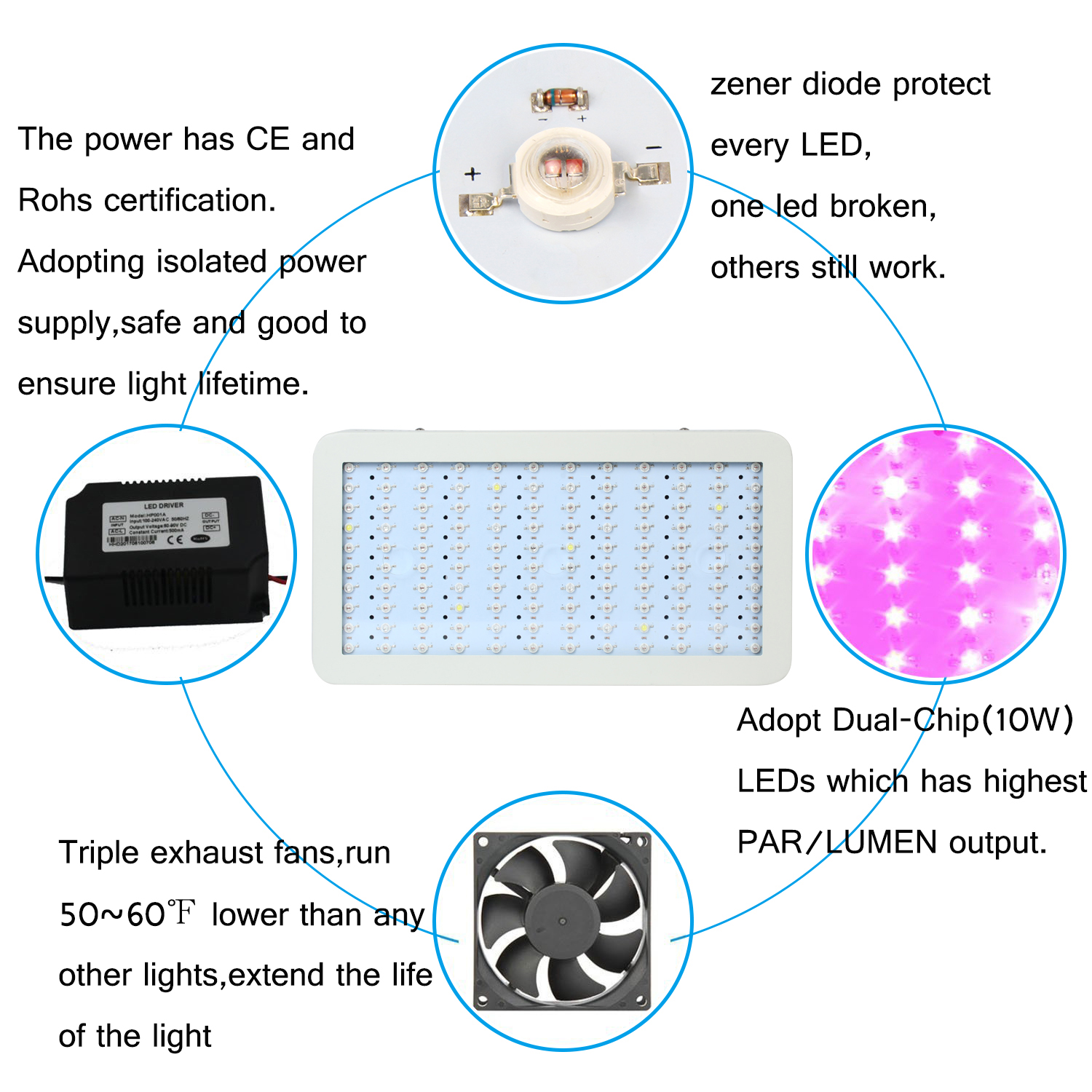

Advantages

Plug with listed certificate safe to use.

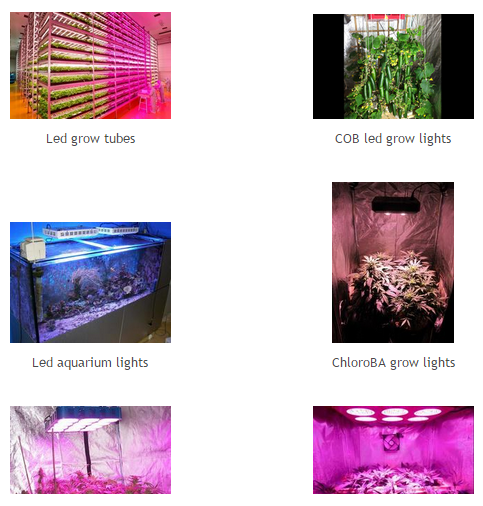

Application

Fruit and Vegetables Growing

Flowers Growing

Special Crops Growing

Leaf and Seeding Growing

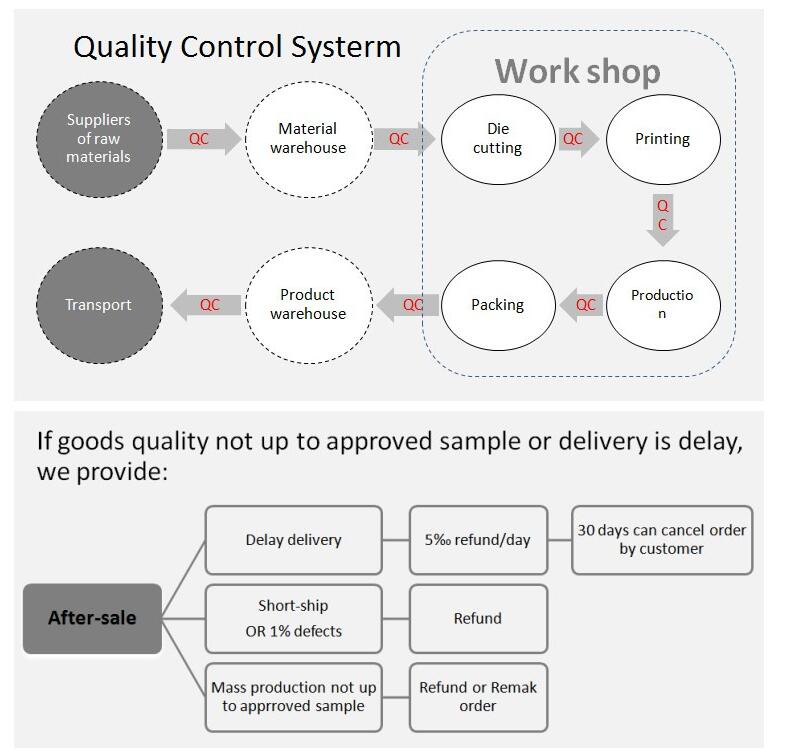

Our Quality Control systems and after-sales

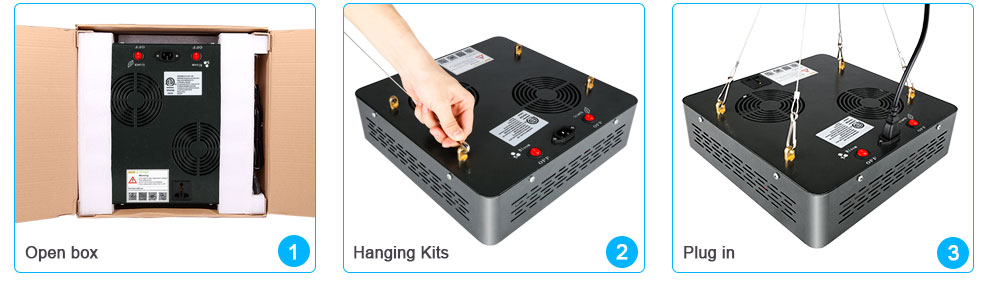

Package

Why Choose us?

Cooperative Policy:

Providing production schedule photos to ensure you know every process.

Profrssional follow-up team, one-to-one service in time.

Shipment sample for checking before shipment.

Priority to get the our lastest product information after cooperation

Good after-sale service offered, please send us feedback if you have any questions

Low Risk Promise:

Sample 3pcs: Lead time 3 working days.

500pcs order: lead time 5~8working days

10000pcs order: Lead time 20~28working days

Warmly welcome to take a visit on our factory at any time and we can pick you up.

Vegetable Garden Led Grow Lights,Vegetable Garden Plant Grow Lights,High-Power Led Plant Light,High Power Led Grow Light

Shenzhen Phlizon Technology Co.,Ltd. , https://www.szledplantgrowlights.com